|

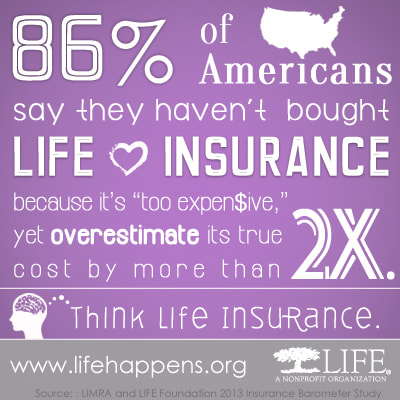

Insurance provides protection against unexpected and potentially costly events. However, the cost of insurance has been increasing in recent years, making it more and more costly . Insurance prices have been on the rise due to an increase in claims and a rise in the cost of materials and labor for repairs for your home and cars. Here are some tips on how to lower your cost of insurance...

Accurate Information Many times inaccurate information may be artificially increasing your premiums. Has your home had any updates with roof, plumbing, heating, electrical? Any updates will usually trigger a discount off the premium. Do you have a central reporting fire or burglary alarm? Have you reported fewer annual miles to your car insurance company since working at home? Is a young driver away at school? Make sure you review all your details with an agent to get all the discounts you deserve. Deductible Discount Insurance companies are now offering higher deductibles for a significant discount. You may see up to 20% off with a 2500 deductible on your home insurance, and car insurance deductibles can go up to 2000 for saving there too. Shop Recently, non-franchise carriers like Travelers and Safeco have been more competitive with their rates, so be sure to check with a broker who works with multiple companies to get the best available plan. Want Help? We can shop for you. Text 714-900-2363 with a picture of your VIN and Driver License to shop for home and auto package rates today.

0 Comments

Flood insurance is a crucial aspect of protecting your property from damage caused by floods. However, not all flood insurance is the same. There are two main types of flood insurance: private flood insurance and Federal Emergency Management Agency (FEMA) flood insurance. Private flood insurance is purchased through private insurance companies, rather than through the government. These policies typically offer more flexibility and customization options than FEMA flood insurance, allowing homeowners to tailor coverage to their specific needs. Additionally, private flood insurance may offer more comprehensive coverage, including coverage for sewer and drain backups, which is not typically covered under FEMA flood insurance. FEMA flood insurance, on the other hand, is administered by the National Flood Insurance Program (NFIP) and is only available to homeowners in participating communities. These policies are typically more affordable than private flood insurance, but they also have more limitations. For example, FEMA flood insurance has limits on the amount of coverage available for certain types of property, such as personal property or contents. Additionally, there may be restrictions on coverage for certain types of flood damage, such as damage from storm surges or flooding caused by poor maintenance of a drainage system. Another difference between private and FEMA flood insurance is that private flood insurance policies may have higher deductibles than FEMA policies. This means that homeowners may have to pay more out of pocket before the insurance kicks in. However, private flood insurance policies may also have lower premiums than FEMA policies, which can be beneficial for some homeowners. Ultimately, the decision between private and FEMA flood insurance will depend on your specific needs and circumstances. Homeowners should carefully consider their options and consult with a reputable insurance agent to determine the best coverage for them. It's also important to note that in some cases, private flood insurance may be required in addition to FEMA flood insurance, depending on the lender's requirement. In conclusion, both private and FEMA flood insurance have their pros and cons, and homeowners should carefully consider their options before choosing a policy. While private flood insurance may offer more flexibility and comprehensive coverage, it may also have higher deductibles and premiums. On the other hand, FEMA flood insurance is typically more affordable, but it also has more limitations. It's important to consult with a reputable insurance agent to determine the best coverage for your specific needs and circumstances. Contact Us for More Information!

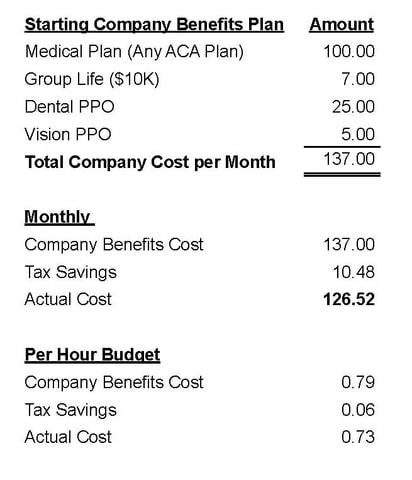

How can I attracted new employees to work for my business for 73 cents?! A Group Benefits Plan can help any business attract employees, and retain them longer while increasing employee satisfaction and loyalty. Why are Benefits Plans so Important? Are you considering raising hourly wages to attract and keep employees? STOP! Do this first - Consider what people are looking for. Maybe a current employee has a medical concern that a doctor visit can help to address. Perhaps another has put off getting their Dental work until they can get dental insurance. Someone else may need glasses, but cannot afford the expensive exam and frames. So many people are in this position and don't even know how to get these insurance plans outside of a company plan. These basic needs can be address with an entry level benefits plan with Medical, Dental, Vision and Life Insurance. What can I offer my employees for 73 Cents? Instead of raising wages to keep and attract new employees, a business owner can allocate 73 cents per hour toward their employee benefits plan that includes Medical, Dental, Vision and Life Insurance. Yes, all of these benefits can be offered with 73 cent per hour starting budget. Don't believe me? Here's how to do it: * Keep in mind, this is the company side of the equation. There are additional costs that the employee will need to decide on which benefits to accept, and contribute toward their share of the costs by payroll deduction.

What are the tax savings referring to? When a benefits plan is introduced, the expenses are paid on a pre-tax basis. That means the company and employee contributions are not considered taxable income. You see this often with 401k or other retirement plans, but it also applies to most group benefits plans. The pre-tax deductions also benefit employees as they will not pay taxes on their contributions. Win-Win! *Of course, contact your tax advisor to verify your plan is set up properly. I don't know anything about this stuff, where do I start? Good news! There are many resources available to you. Ask around for a referral to a good Independent Benefits Broker in your area. Someone like this will help you search for the best available plan for your employees, consider your budget, and help administer the enrollment and employee questions. If you don't know anyone, your local chamber of commerce, or business organizations can be a good starting point. You can also get help from the trade associations like CAHU, the California Association of Health Underwriters. This seems like a lot of hassle! Yes, you will spend a couple of hours getting this all set up. After that, most of the work is done by the insurance companies in servicing your employees needs. Then, next year it will be easier! Questions? Contact us for any questions: Call/Text: 714.900.2363 George Varela Pacific All Risk Insurance Brokers Make Benefits Enrollment Easy Make your open enrollment process Easy with a Benefits Admin Portal and Professional Advice from Experienced Agents.

Contact us for more info:

|

AuthorInsurance News from the insurance experts to the business and personal community. Archives

March 2023

Categories |

Pacific All Risk Insurance Brokers, LLC

RSS Feed

RSS Feed