Health Insurance - Special Enrollment Period Extended! Covered California announced this morning that it would be giving consumers more time to sign up for health care coverage during the COVID-19 pandemic by extending the current special enrollment deadline through July 31, 2020. If you or someone you know does not have health insurance, Sign Up today! Contact Us, we can help. Call/Text: 714-900-2363

0 Comments

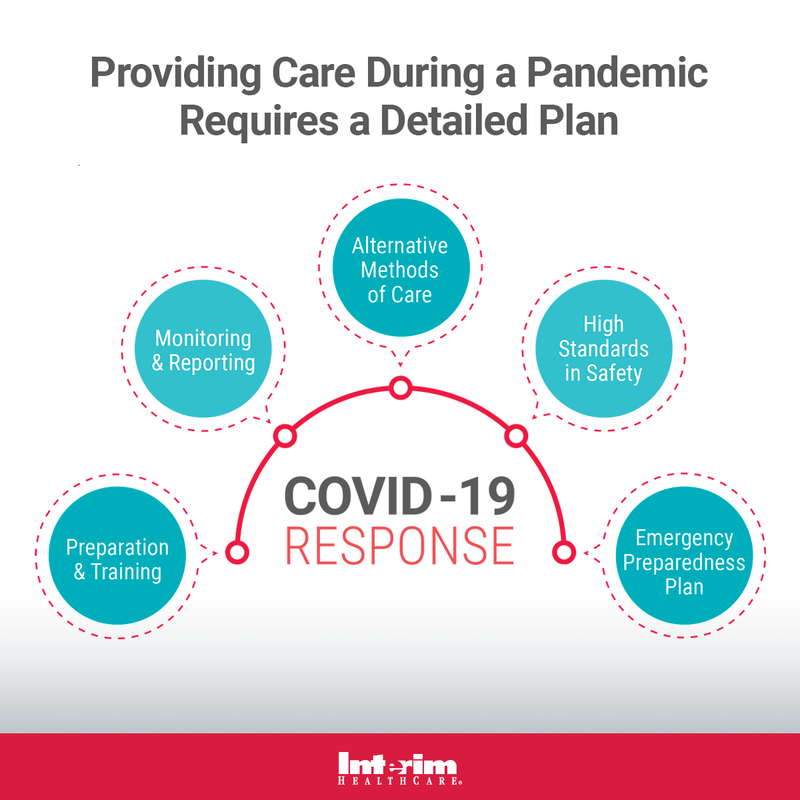

What do employers do if one of their employees has Covid-19? Many times, people who have tested positive do not feel any symptoms but with careful screening, employers can stay one step ahead. Temperature screening services are needed on site for employers who want to keep their employees safe and healthy. Through a careful process development, screening with temperature checks and a short questionnaire for all who enter a workplace or worksite; employers can keep their employees safe by reducing the risk of having an employee, vendor, or visitor spread the virus to others. Get the healthcare workers, infrared touchless thermometers, and the Personal Protective Equipment (PPE) that are needed to keep employees safe.

For More Information Contact: Interim HealthCare in Anaheim Direct Line: 714-714-7603 http://www.interimhealthcare.com/AnaheimCA Go Back to Work Confidently with Paycheck Protection

Are you ready to get back to work at full capacity? Are your Employees worried about getting sick with COVID? What happens when someone gets sick? Will they lose their hours and their paycheck until they are better? Paycheck Protection is available to all Businesses with 5 to 100 employees. This is a group insurance plan that will replace a majority of a workers wages for up to 6 months if they get sick (Including COVID-19) or injured and they are not able to work. The paycheck protection plan is only $2 to $8/month and it can be bundled with common benefits like health, dental, vision and life insurance for added benefits and savings. This is not workers comp, it is an additional benefit that help pay rent, buy groceries and pays bills! Ready to get employees to go confidently back to work? Contact me to get started. Call or text: 714-900-2363 or Click Here to Schedule a Conference call Have Benefits Plans adjusted to deal with COVID? What do I pay for an ER Visit? What happens when I get quarantined for 3 weeks? If I get sick at work, do I get any help with lost wages?

Before the COVID-19 virus crisis, healthcare was already in the top three concerns of most people. Now that we are dealing with a virus outbreak. It is even more important to make sure health insurance coverage is set up to address how we might use our coverage for treatment. Since 67% of the population is covered by Small Business Group Insurance. We are going to discuss solutions for small groups. What do I pay for an ER Visit? Emergency Room visits are never planned and neither are the expensive bills they can rack up. Most health plans have a deductible from $2000 up to $7000 before the insurance even begins to help. What if I have to be Hospitalized? In addition to the deductible, many health plans have Co-Insurance Cost sharing. Once you spend a night in the hospital, the co-insurance is billed to you. Co-insurance amounts start at 10% of the hospital bill and can go up to 50% of the bill. This is not new. These amounts are a normal part of health insurance plan designs. Do I get any help when I am out of work while quarantined, sick or recovering? Many states have expanded government programs to include unemployment or sick pay during the COVID crisis. In other times, we have had to rely on earned sick or vacation time offered by employers or just take unpaid time off. Here are some additional resources available in California. https://www.labor.ca.gov/coronavirus2019/#chart SOLUTIONS Health Plans Some health insurance carriers have recently introduced new group health plan options that provide higher levels of benefits, lower copayments and coinsurance amounts and maintain a good network of provider medical groups and hospitals. Complimentary Coverage There are some little used group benefits that help fill in the gaps of primary medical insurance. These plans can help pay for deductibles, co-payments and can add benefits. Other plans can help replace lost income when sick or injured and unable to work. Optimized Benefits The best solution is to coordinate the available benefits to mesh together to provide seamless coverage, improved quality of care, and reduce overall benefits costs. Who Should Make Changes Now?

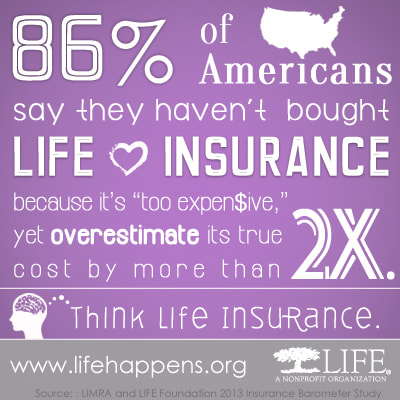

Contact Us for More Information: Text/Call: (714) 900-2363 Email: george@pacificarib.com ZOOM: 944 595 1957 Calendly: https://calendly.com/pacificarib/60min\ Covid- 19: the Effect on Life and Disability Insurance Covid-19 has changed how insurance companies are accepting and reviewing applications for life and disability insurance. The changes implemented may be temporary, yet with the unknown outcome of the virus, most insurance companies are being more cautious. The good news is that many companies are skipping the medical exam requirement to apply, but are heavily relying on medical records, prescription checks and signed statements of Covid-19 contact. Should you wait? The problem with waiting is that you may never get around to it or risk getting sick or injured then it may not be possible. If you are healthy, get it now. Don’t wait! If you are worried about meeting face to face, meetings can easily be held over Zoom. Applications can be submitted and signed electronically as well. What do I recommend? Work with an insurance professional. There has been a rise of online life insurance applications. Although there is nothing wrong taking care of it yourself, these premiums may be slightly higher. An insurance professional would review your situation, shop around to different companies and give you a better idea of your options and cost. Not everyone’s situation and need are the same. If you currently have a life or disability insurance policy, you should also set up an appointment for a review. A recent life change like a new baby, house, or job may change your insurance needs. Other items to review would be your beneficiaries and your employer coverage. There are a lot of bases to cover so leave it to the professionals to help. For more information, please contact: Melissa Delgado Insurance Professional MDIS: Melissa Delgado Insurance Solutions (714) 603-6539 melissa@mdis.io or Contact Us for More information! Text/Call: 714-900-2363 |

AuthorInsurance News from the insurance experts to the business and personal community. Archives

March 2023

Categories |

Pacific All Risk Insurance Brokers, LLC

RSS Feed

RSS Feed