Contact Us for More information! Text/Call: 714-900-2363

0 Comments

IMPORTANT 401K PLAN EMPLOYEE BENEFIT NEWS

This week - A Large Payroll company is being sued over its role as the fiduciary of a multiple-employer 401(k) plan by a sponsor that alleges ERISA violations, such as allowing "unreasonable" record-keeping and administrative fees and selecting "high cost and poorly performing investments." What does this mean?

Have Questions? Contact Us for a Free Employee Benefits Plan Evaluation. Call/Text: 714-900-2363 Pacific All Risk Insurance Brokers From Our Friends at Accrew Bookkeeping... An interactive workshop on how to keep businessing when the world is not business as usual. Sign up to join here: https://bit.ly/2Vw6mK8 As business owners, we’ve felt overwhelmed by the information coming at us on a daily basis. There are new rules and opportunities like never before, but it’s hard to sift through to get practical steps to take.

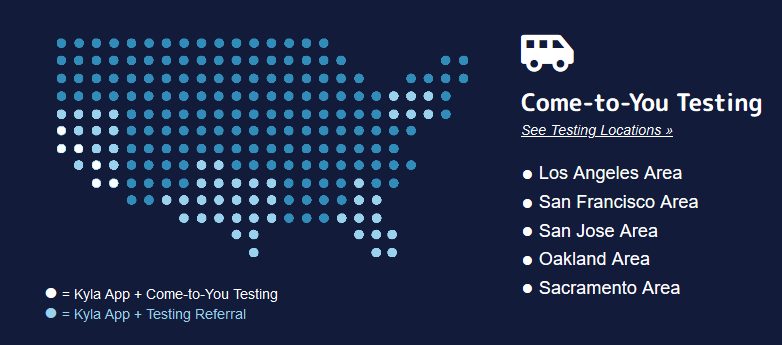

That’s why we’re providing a weekly workshop to help businesses get information quickly and questions answered so they can apply it in their business today. This week, George Varela will be speaking about How To Reformulate Group Benefits Now to Address Changing Budgets and Benefits Needs. As companies and government agencies send their employees home to avoid contact with the coronavirus, many cyber-security teams are facing the unenviable challenge of securing sprawling, vulnerable networks.

Every time an employee connects to their corporate network from home, they’re creating possible access points for hackers to exploit. Here are some tips that can help your business... Risks: What are the current risks for data intrusion, theft, and hijacking? Today’s information highway is ripe with potentially catastrophic exposures from:

Repercussions: What happens when someone has access to my company and client data? A targeted attack on your business damages your bottom line in many ways including:

Prevention – What can I do to make it harder for my data to be accessed by unauthorized people? The number one way to prevent invasion of your business data is to be prepared by:

Protection – What can I do if my data does get hacked or stolen? The number one way to protect your business from liability, is to get a Cyber-liability insurance policy. This type of coverage will help to:

For More Information on Data Protection Contact: Agile Enterprise Management For More information On Cyber Liability Insurance: Text/phone: 714-900-2363. When employees are unable to work because of a disabling injury or illness, Short-Term Disability Insurance helps by replacing part of their income.

An employee’s savings might not be enough if an illness, injury or pregnancy keeps them out of work beyond their paid sick days. Short-term disability insurance (STD) helps protect employee income during extended work absences and can help employees pay the bills when they cannot work due to a covered claim. Short-term disability insurance replaces a portion of an employee’s income for covered illnesses and injuries sustained outside of work.

Contact Us to help your employees get covered now. Call or Text: 714-900-2363 CalSavers is California’s new retirement savings program for workers in the private sector who do not currently have a way to save at work. Eligible employers with at least five employees that do not already have an employer-sponsored retirement plan will be required to begin offering one via the private market or provide their employees with access to CalSavers by the following deadlines:

The cost of CalSavers investments (consisting of an underlying fund fee, a state fee, and a program administration fee) could be approximately twice the cost of a typical 401(k) investment. Please contact us for more information on starting a company retirement plan that works best for you and your business. Here are some key features of CalSavers that eligible California employers should be aware of:

Employers that do not already have an employer-sponsored retirement plan may want to examine implementing one based on the following considerations:

Which retirement plan is right for your business? Businesses with no employees As a business owner, you know your company’s success takes preparation and effort. Your retirement years are no different. The appropriate business retirement plan can incorporate the flexibility you need while helping you to prepare for your retirement – as well as attract and retain quality employees. Once you’ve determined your objectives, you can evaluate your options based on the needs of your business and employees. Then you can begin selecting the right retirement plan for your business. If you’re like many other self-employed individuals, you probably want to know how much you can save for retirement each year and how your contributions will affect your taxes, now and in retirement. There are three primary options available to help you achieve your goals:

Whether you have employees or not, the retirement plan you choose may have a large impact on your personal and professional life. I can help you weigh your options and educate you on the different plan types available for you and your business. For More Information, Contact: Derick M Roberts Financial Advisor – Edward Jones 2223 East Wellington Avenue Suite 310 Santa Ana, CA 92701-3161 714-543-9632 derick.roberts@edwardjones.com Thorough documentation is a critical part of performance management. It’s also a vital component when building an employer’s defense against complaints. While an absence of documentation can be devastating to an employer’s defense, poorly written documentation can be just as damaging. And how do you document performance when managing remotely. Learn WHAT to say and HOW to frame the feedback message to correct performance deficiencies and if necessary provide a legal basis for discipline.

WhenMonday, May 4, from 2:15pm - 3:15pm PT WhereOnline Webinar **Free for EVERYONE This presentation will explore:

|

AuthorInsurance News from the insurance experts to the business and personal community. Archives

March 2023

Categories |

Pacific All Risk Insurance Brokers, LLC

RSS Feed

RSS Feed